Calibrating the Tariff Shock

The single worst shock since 1815 in all of its gory detail.

The revised schedule of “reciprocal” tariffs contained in President Trump‘s modified Executive Order of July 31 confirms the details of a painfully obvious shock. It takes the average effective tariff rate back to Smoot-Hawley-like levels last seen in 1933 when the US was mired in a global trade war and the Great Depression. It is the sharpest one-off increase of US tariffs in modern history.

As per the executive order, the detailed tariff rates proposed for 69 countries adds a little more granularity to my most recent update of the tariff shock:

First, the new schedule does not alter earlier estimates of the overall US tariff rate. By Yale Budget Lab calculations published on August 1, the overall average effective tariff rate will go to 18.3% in 2025, once the new rates go into effect on August 7. That is virtually identical to the 18.4% estimate made by YBL just prior to the actions of Liberation Day 2.0.

Second, tariffs are higher for trading partners that account for the bulk of the US trade deficit. The average tariff rate proposed for the top 20 deficit countries works out to 23.6%, if scheduled tariff rates are weighted by 2024 shares of the total US merchandise trade deficit. It follows newly proposed tariff rates will be around 13% in 2025 for the remaining 49 countries on the latest Trump tariff schedule — still nearly five times average tariffs over the preceding five years.

Third, there are three peculiar outliers in the latest tariff schedule — 10% tariffs on two countries with trade surpluses (Brazil and the UK) and an outsize 39% tariff on Switzerland. Based on media reports, there is a good chance that tariffs will be lowered in Switzerland but raised for India; with each accounting for about 3% of the total US merchandise trade deficit, these adjustments should be largely offsetting.

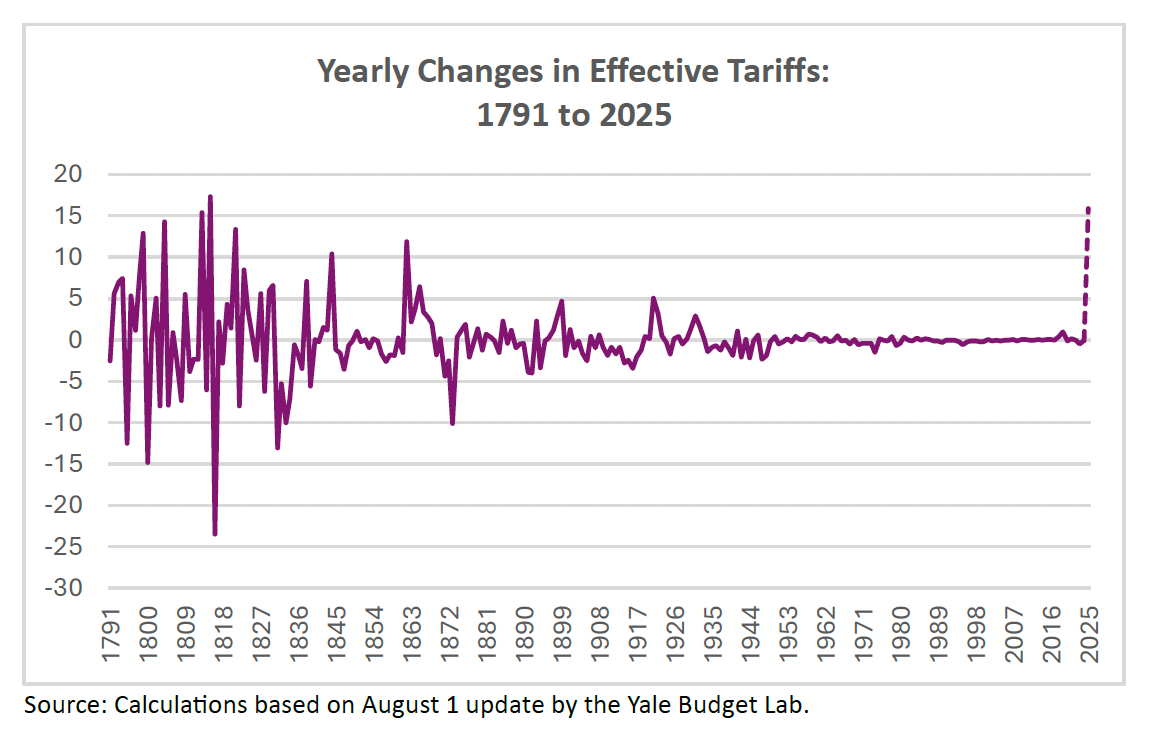

The shock effect of these actions cannot be overstated enough. As can be seen in the chart below, which plots year-to-year changes in average effective tariffs, the 15.9 percentage point increase now likely for 2025 — 18.3% in 2025 less 2.4% in 2024 — is, by far, the largest increase in modern times (post-1900). Looking back at the entire sweep of US economic history (dating back to 1791, thanks to the invaluable forensic assessment of Yale Budget Lab), the estimated 2025 spike falls short of one which occurred over 200 years ago (a 17.3 percentage spike in 1815 when James Madison was President). This point bears repeating: The 2025 Trump tariff shock is the single worst US tariff shock since 1815!

The largest multi-year cumulative increase in US tariffs was during and immediately after the Civil War — a seven-year period from 1862-68 when average tariffs were boosted by 32.3 percentage points. At the same time, the Trump shock of 2025 is far greater than that which occurred in the late 19th century, when the so-called McKinley tariffs eventually led to a 9.4 percentage point cumulative increase in average tariffs over a four-year period, from 1896 to 1899.

Donald Trump, who changed the name of Denali, North America’s highest mountain, back to Mount McKinley, has expressed great admiration for McKinley’s tariff-centric approach to government finance that he mistakenly associates with US manufacturing supremacy. For the record, the US was primarily an agricultural economy in the late 1890s — farm employment accounted for about 42% of the workforce over the 1890 to 1900 period versus about 20% in manufacturing. Those trends, of course, were to reverse in the decades that followed as the US eventually emerged as a major industrial power, but there is little, if any, evidence that this transformation can be explained by increased tariffs in the second half of the 19th century. Trump, of course, is never one to let facts get in the way of his extreme claims.

Speaking of facts, the above estimates of US employment shares in the late 1890s are drawn from the research published by the National Bureau of Economic Research, specifically from the work of the renowned labor economist, Stanely Lebergott. While he had a long career as a professor at Wesleyan, it should also be noted that Lebergott began his career as a labor economist at the US Bureau of Labor Statistics, where he compiled the definitive statistics on US employment from 1890 to the 1950s. This was only one of many such important research efforts that took place over the long and rich history of the BLS — an agency now under unconscionable attack by a President with a notoriously strong disdain for fact-based expertise.

But that is beside the main point I am trying to make on the shock effect of Trump’s destructive tariffs. Not only is the tariff hike of 2025 of singular importance in the modern history of the United States, but it has fostered a record surge of policy uncertainty. I first pointed this out about three months ago, when I took issue with the positive spin that Team Trump was putting on the notion of “strategic uncertainty” — the far-fetched idea that the alleged “genius” of Trump was his uncanny knack to intimidate adversaries into submission by executing a grand plan of chaos and disruption. My dismissal of this claim was key to my overall macro assessment that such politically-orchestrated volatility would seriously crimp decision making — especially for businesses but eventually for consumers — and push the US economy into the danger zone.

I supported that contention by drawing on an index of “trade policy uncertainty” (TPU) that was developed by academics and published daily on the Economic Policy Uncertainty (EPU) website. The various indexes compiled by the EPU are largely media-based, drawn from reports of major news outlets. While the trade policy uncertainty index spiked in the early days of Trump 2.0 — especially around the April 2 Liberation Day pronouncements — it then receded a bit as some semblance of “shock fatigue” settled in. Even so, as the chart below indicates, the index remained sharply elevated relative to its 2020 to 2024 five-year average and then spiked up again in the days immediately following the July 31 pronouncements of Liberation Day 2.0

The link between an uncertainty shock and the US business cycle is now a hot topic of debate in financial markets — finally, I might add. A major shortfall of employment growth in July, in conjunction, with sharp downward revisions to May and June, is a classic sign that a cyclical turning point may be close at hand. Former Fed Chairman Alan Greenspan, a master sleuth of statistical analysis, long stressed the important information content of data revisions. Not only are they perfectly normal occurrences as small samples are expanded over time, but as Greenspan argued, a succession of downward revisions is a strong signal of incipient economic weakening. That’s the key message of the July employment surveys.

Politicians, especially Donald Trump, don’t have a clue about the analytics and science of statistical evidence. They can shoot the messenger — in this case, now former BLS Commissioner Erika McEntarfer — but they can't recast the reality of one of the largest policy shocks in US economic history. The economic legacy of Tariff Man could well outlive that of his MAGA cult.

I keep thinking that Trump’s erratically announced tariff levies will cause meaningful harm to our economy, but so far the feared results have not surfaced.

Although last week’s unemployment numbers, and especially the revisions, might augur the surfacing of the negative impact of his wild policy.

Economists have been saying that businesses are ‘hoarding’ workers, and the situation is fragile, just needing perhaps some negative numbers.

Anyway, I am viewing the tariff madness as creating tremendous uncertainty, as creating declines in income for business, and for higher costs and less spending or saving for consumers.

There will be less net income for everyone, more tax (tariff) revenue for the government. And some uncertain amount of inflation.

And this is not to mention the extreme ill will we have created all over the world. I speak randomly to people in Asia and less so in Europe. While countries cannot stop doing business with us, wherever possible they will reduce their business with us, and even at the margins I believe that this can have a significant negative impact for our economy.

Not to mention our status in the world.

Considering the above issues, the world already being heavily overweight US equities is not a good place to start from. The dollar, which Stephen, Ken Rogoff and others have mentioned is whole ‘nother story.

( Personally I am putting new cash, with some exceptions, in other than US equities.

In my opinion there are also significant credit opportunities for very strong yields with smart and proven money managers in Asia and the US.)

And obviously Trump’s foolish attacks on the Fed will make it harder for them to ease.

Lastly, and ironically, the Payroll numbers that Trump detested are the best news yet for lower rates.

Yikes, this was much longer than I intended to write…Sorry