Setting the Record Straight on Inflation

Unmasking one of the President's biggest economic lies

During a December 2 cabinet meeting, President Trump made a number of false claims. As an economist, the one I took greatest exception to was his utterly absurd statement that, “I inherited the worst inflation in history. They say it’s the worst inflation in 48 years, I say ever.” He has said that so many times in the past, without any corrections from his so-called professional team of economic advisors, it is time to set the record straight.

Yes, CPI-based inflation surged to 9.1% on a year-over- year basis in June 2022, and yes, Joe Biden was president at the time. Never mind that there is now broad consensus that this surge was largely attributable to severe post-Covid supply chain disruptions, reflecting the impacts of a pandemic that were terribly mismanaged during Trump 1.0. I well remember the President’s famous false assurances about Covid from February 2020, “It’s going to disappear. One day — it’s like a miracle — it will disappear.”

Well, that one day finally did come but far too late to avoid the lingering affordability problem that the nation now painfully faces, first under Biden and now, under tariff-loving Trump. But that’s beside the point of this missive. My focus here is not about blame, or even cause and effect — which would have to bring a deficit-prone Congress and a “transitory” misdiagnosis of inflation by the Fed into consideration — but more about setting the record straight on President Trump’s blatant falsification of historical fact.

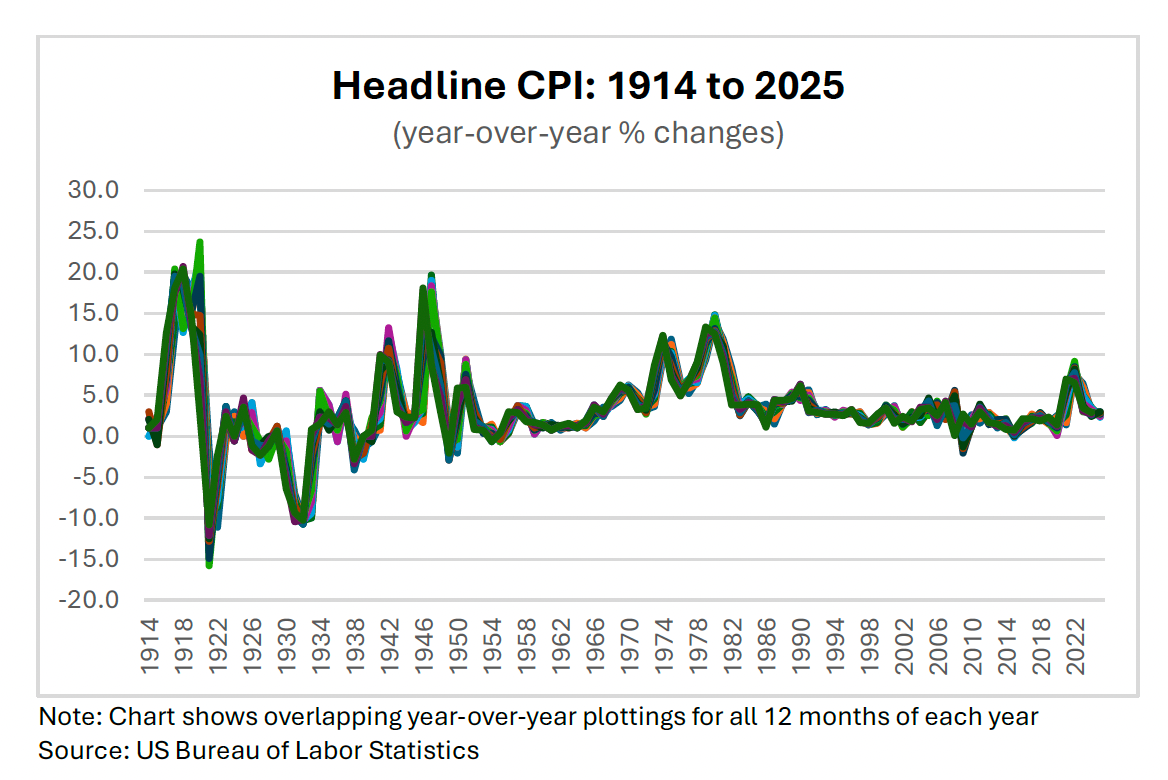

First of all, the 9.1% increase in the headline Consumer Price Index recorded in June 2022 was not a record by any stretch of the imagination. As can be seen in the chart below, the CPI was up 9.6% on a year-over-year basis in December 1981. That’s 44 years ago, not the 48 years Trump attributed to the anonymous “they” in his recent cabinet meeting. It came at the tail end of a period now known as the Great Inflation (see discussion below), where the CPI peaked at 14.8% in March 1980, fully 5.7 percentage points above the false record Trump claims that Biden left him. Back then, of course, it took a wrenching monetary tightening by the Federal Reserve under the courageous leadership of Paul Volcker to curtail an out-of-control double-digit inflation — the opposite of the massive monetary easing Trump is now demanding.

Similarly, an earlier period in the aftermath of the first OPEC oil embargo of 1973-74 pushed the CPI inflation rate up to a peak of 12.3% in December 1974, again well in excess of the so-called Biden peak of 9.1%. That occurred following the 1973 Arab-Israeli War when I was an economist at the Federal Reserve Board in Washington. Many of us on the Fed’s staff agonized over the significance of this extraordinary price shock. As history painfully revealed, our boss at the time, Fed Chairman Arthur Burns, persisted with an overly accommodative monetary policy during and after the near quadrupling of world oil prices, keeping CPI inflation sharply elevated through 1979 before a second oil shock hit following the Iranian Revolution.

As the chart also shows, there was a third post-World War II inflation shock in the immediate aftermath of World War II and the Korean War, taking the CPI inflation rate up to a peak of 19.7% in March 1947 and again up to 9.4% in February 1951. While these earlier gyrations of the late 1940s and the early 1950s, as well as comparable large increases from 1916 to 1929, are traceable to war-related disruptions and/or price controls, like it or not they are also woven into the fabric of American economic history. Significantly, all these bouts of inflation were considerably greater than that which Trump falsely claims as the worst inflation in history that he inherited from his predecessor.

What I find most galling about Donald Trump’s arrogant recasting of history is the “they say” … but … “I say” verbiage in his characterization of record US inflation. The Great Inflation, which I will define as a year-over-year CPI inflation rate running above 5%, lasted from April 1973 to October 1982. Over that nine-and-a-half-year period, inflation averaged 9.0%, virtually identical to the one-month 9.1% spike that occurred in June 2022. In fully 45 of the 115 months of the Great Inflation — in 1974-75 and from early 1979 to late 1981 — the US was ravaged by double-digit inflation. Speaking for the “they say” constituency, I can only conclude that the so-called Biden record that Trump continues to harp on with his “I say” assertion is not even worthy of comparison.

President Trump obviously has a very different perception of what the word “history” means. To him, most bad things — inflation, in this case — can be traced back to his nemesis, Joe Biden, who defeated him in the presidential election of 2020. Sometimes he reaches back to the Obama era when bemoaning a point on healthcare costs. Yet this recasting of history, whether through the “alternative facts” prism of his first days in office or a blatant disregard of the historical record carefully compiled by the US Bureau of Labor Statistics, undermines the sanctity of the office he holds. But I digress.

My bottom line on Trump’s lies about inflation has important implications for the honesty and credibility of the policy team charged with managing the world’s most important economy. Treasury Secretary Scott Bessent, Commerce Secretary Howard Lutnick, and perhaps most importantly, National Economic Council Director Kevin Hassett — rumored to be the leading candidate for the next Chair of the Federal Reserve — don’t dare to correct Trump’s longstanding penchant for falsehoods on the state of the US economy. Better to let it go and compromise integrity, rather than risk the wrath of the Great Intimidator. Speaking truth to power doesn’t cut it in Trump 2.0, where power becomes “truth.”

Needless to say, that doesn’t send the most comforting message to financial markets. Trump is not only searching for a new head of the Bureau of Labor Statistics who may be inclined to spin new data better aligned with his warped sense of history, but he has been emphatic about finding a new Fed chief who will ease monetary policy in accordance with his political views. So much for the crucial foundation of Fed independence. With today’s 3.0% inflation rate (as of September 2025) still running well above the Fed’s price stability target of 2.0%, there can be little wonder why bond investors are starting to get nervous.

Was 9.1% an “annualized” one month reading or did prices actually increase 9.1% in one month.