Inflation Update: From Biden to Harris to Powell to Trump

The political economy of a persistently elevated price level

The Democrats have changed presidential candidates, but a key problem remains the same: while the inflation rate has come way down, for the average American, the price level remains unacceptably high.

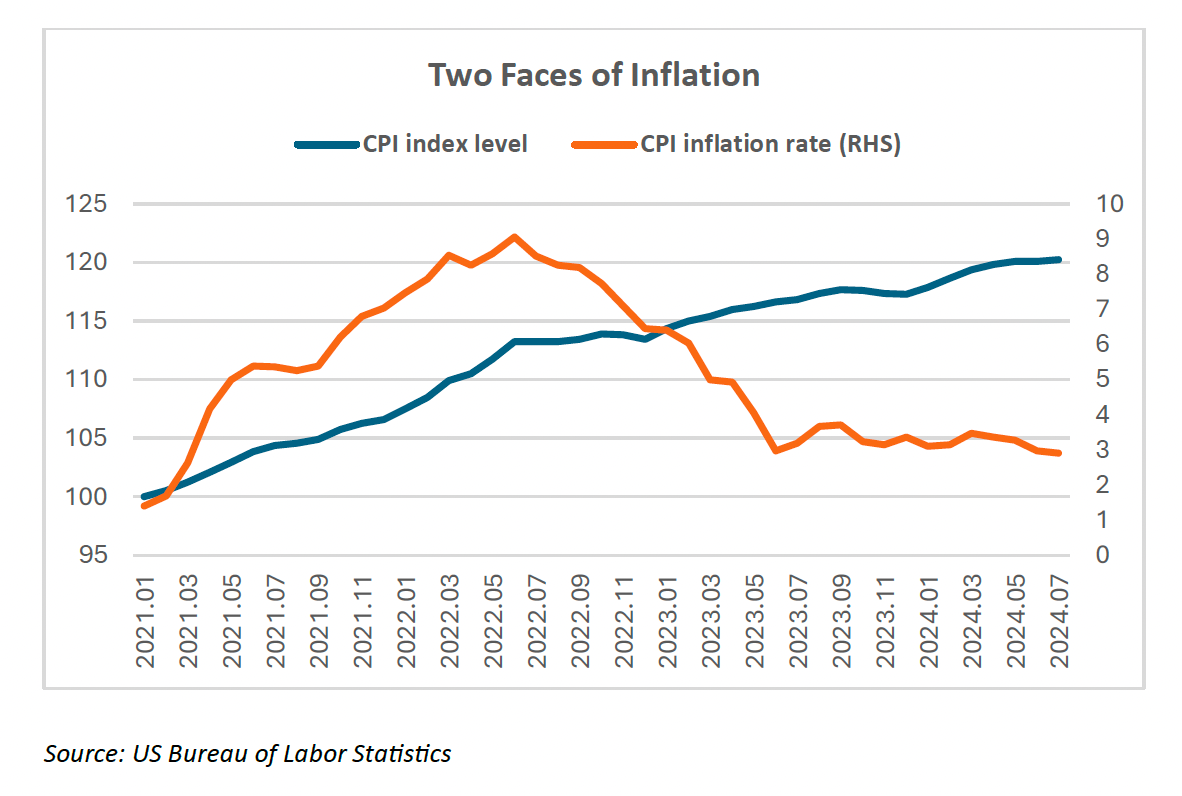

You would never know that from the market response and commentary after the August 14 release of the July Consumer Price Index report. With the headline CPI (at 2.9% y/y) falling back below the 3.0% threshold for the first time since March 2021 and the core CPI moving down to a 40-month low at 3.2%, US equities and long-term Treasuries have rallied sharply while the dollar has weakened.

Market participants have concluded that the first Fed rate cut of this cycle is now close at hand, possibly as soon as September. Fed Chair Powell’s dovish Jackson Hole remarks, on the heels of the recently released minutes of the July 30-31 FOMC meeting, have left little doubt that the balance of risks to monetary policy has now shifted. With reduced upside risks to inflation and increased downside risks to employment, Powell stressed that, “the time has come for policy to adjust.” The Fed chair made a special effort to emphasize his increased confidence in the likelihood that “inflation is (now) on a sustainable path back to 2 percent.” The July CPI report pretty much sealed the verdict on the coming shift in monetary policy, although Powell understandably left open the debate on the “timing and pace” of likely rate cuts.

The White House has been quick to celebrate the round-trip trajectory of the CPI after the Covid-related spike of 2021-23. Moreover, a former deputy director of the National Economic Council, Bharat Ramamurti, exclaimed that “we’ve won the battle against inflation.” Paul Krugman, Nobel Prize winning columnist for the New York Times, penned an op-ed with the title “What Happened to Inflation?”

Notwithstanding this newfound euphoria over inflation, I continue to believe that there is an important political caveat to this conclusion. While the inflation rate has decelerated sharply over the past two years, the price level remains sharply elevated. In July, the headline CPI still stood some 20.2% above the level prevailing in January 2021 when Joe Biden took office. If there had been no Covid-related inflation shock and the CPI had held to its 1.5% annualized trajectory prevailing from 2014 to 2020, the latest reading on the CPI level would still have been 14.8 percentage points above its January 2021 level.

These calculations, illustrated in the figure below, are virtually identical to those I made a couple of months ago when I first started writing about this issue after the release of the May CPI report. The level of food prices has, in fact, inched up higher in July from the May reading; the same has been the case for medical supplies, alcohol and tobacco, and a broad array of non-energy services prices, especially shelter. But only partial offsets have been evident in energy, apparel, and cars (new and used). All in all, there can be no mistaking the lingering pressures of a sharply elevated price level for the overall CPI

As I have stressed repeatedly, this aspect of the inflation problem has especially important political consequences ahead of the upcoming US presidential election. It was a major thorn in the side for Joe Biden and seems likely to be the same for Kamala Harris. Voters could care less about all the permutations and combinations of core, smoothed, and sticky inflation rates. They respond more to pocketbook issues embedded in the elevated price level. Consequently, while politicians may be tempted to draw comfort from the market’s euphoria over sharply reduced inflation, my advice remains the same — don’t ignore the still elevated price level. In other words, politicians — unlike investors and Fed policymakers — need to keep the champagne on ice.

The two candidates finally appear to have caught on to this complication. In her first statement on economic policy, Harris framed the issue in terms of “price gouging and corporate greed,” especially for high grocery prices. Her proposed "remedies" were vague, centered around proposed Federal Trade Commission enforcement actions directed at major grocery companies in the first 100 days of her administration; unfortunately, the US experience with administrative controls, such as those which were put in place in the early 1970s, is not great. For his part, Trump has focused more on the elimination of inflation rather than in coping with the elevated price level. Yet his proposals to raise tariffs and challenge the independence of the Federal Reserve draw the likelihood of success from his anti-inflation “program” into serious question.

This problem will not go away. Each month, following the release of CPI, I will continue to update the calculations that I initially made in June. I confess that I am not looking for major relief from the elevated price level. Barring an outbreak of broad-based deflation, which of course comes with its own set of Japanese like risks of protracted economic stagnation, the Covid-related shock of 2021-23 is likely to have an enduring impact on the price level. Even if the so-called round trip of inflation comes to pass and CPI increases move pack to the 1.5% norm of 2014 to 2020, the price level will continue to increase, albeit at a small rate. Joe Biden may have pulled out of the presidential race, but Kamala Harris has stepped into his shoes in facing this critical issue. And Donald Trump brings his own set of baggage to this key aspect of the policy debate.

Politicians, of course, always blame the other side for economic problems. Yet the math of price shocks is unforgiving for a fully employed US economy. Only if a deep recession occurs when the US economy is operating at a time of much more subdued inflation than is currently the case, would it even be conceivable to consider the possibility of a burst of outright deflation that might address the pocketbook concerns of American families associated with a sharply elevated price level. But such an outcome, if it were to occur, would, of course, be accompanied by sharply rising unemployment, introducing a very different dimension of economic distress into the political equation.

Bottom line: There is no easy way out from the price shock of 2021-23. The discomfort associated with an elevated price level is likely to remain an enduring source of pressure on American families. The political solutions to this problem that are currently on the table could well compound the situation.