Not a Real Deal

An early take on the impact of the London non-deal between the US and China

From last month in Geneva to this week in London, US and Chinese dealmakers continue to struggle in their search for a trade deal. Meanwhile, a US Federal Appeals Court has just extended the stay of an earlier legal challenge to Trump’s global tariffs. The net result of these two developments is that it is still very much “game on” for the Trump Administration and its trade war.

Yes, London was a little better than Geneva. The 12 May Geneva Accord between the US and China ended the absurdity of sky-high reciprocal and retaliatory tariffs but did little else other than to offer a process of consultation. A month later in London, that consultation mechanism produced surprisingly narrow results — featuring mainly, a rare earths concession by China and a rollback of some technology sanctions and other recent export controls by the United States, most likely including chip design software, jet engines and parts, and student visas. But, once again, not much else. Bilateral tariffs remain sharply elevated on both sides of this key relationship and seem unlikely to change over the foreseeable future. US and Chinese negotiators continue to use the word “framework” to depict the fruits of their efforts. Call it what you want, but this is hardly the real deal that the dealmakers have long promised (see endnote to this dispatch).

That’s not to minimize the significance of improved US access to China’s abundance of rare earths. The Biden Administration focused on technology sanctions as the centerpiece of its “small yard, high fence” restrictions on China; these efforts have continued, in some cases expanded, in the early days of Trump 2.0. China’s counter was to target an equally vital strategic chokehold in the United States — rare-earth magnets and metals, which are essential to a broad-cross section of advanced manufactured products, from autos and robotics to defense and LED lights, to batteries, electric motors, and medical lasers. In the London negotiations, US-China focus was on reciprocal sanctions relief — balancing off increased US access to rare earths with increased Chinese access to some US manufacturing products (including technology). That was clearly more of an urgent ask for the US. China has not only been dealing with US tech restrictions for about seven years but can boast of important recent successes of Huawei and DeepSeek. The only bragging rights the US can claim on rare earths is a controversial deal struck with war-ravaged Ukraine establishing a joint investment fund aimed at postwar reconstruction — a deal that is, at best, years away from providing a new source of natural resources supply (including rare earths) to US manufacturers. In Trumpspeak, China clearly held more cards in the sanctions battle than the US.

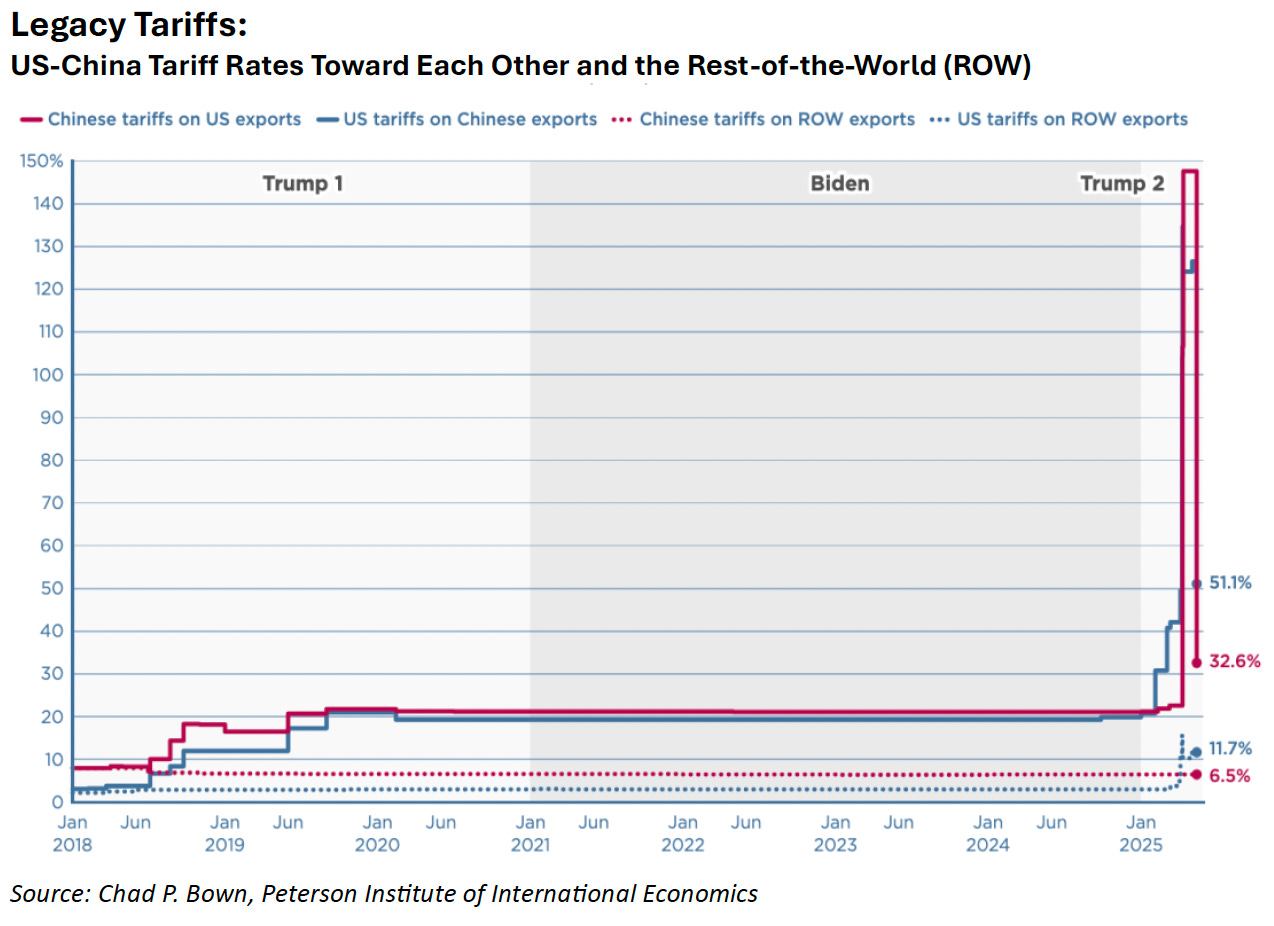

That is not the case on tariffs. In a post earlier today on Truth Social, Trump stressed a major mismatch of tariffs favoring the US over China — 55% to 10%. Unsurprisingly, this is a distortion. The 55% US tariff rate on Chinese imports appears to reflect the combined impacts of the 10% global baseline, a 20% fentanyl penalty, and a 25% Section 301 tariff legacy from Trump 1.0. Trump conveniently leaves out the retaliatory legacy of Chinese tariffs on its purchases of US-made products, estimated by Chad Bown of the Peterson Institute to be running at 21%; Bown’s research also puts US legacy tariffs at close to 20% rather than the 25% implicit in Trump’s latest assessment. That narrows the US-China tariff discrepancy to 50% to 31%, a balance still very much in America’s favor but far less so than suggested by President Trump. Yes, the US has more cards than China in the tariff battle between the two nations, but not by the huge margin that Trump brags about and probably not enough to compensate for the immediacy of the rare earths chokehold that China possesses. Who’s got more cards? The answer comes with time … and, of course, hard data on measurable economic impacts on both economies.

To me, far more significant than the limited results of the Geneva-London framework agreements was a 10 June decision by the US Federal Court of Appeals to extend its earlier stay of a verdict by the US Court of International Trade (CIT) that had effectively overturned Trump’s global tariff scheme. This was not the quick, definitive ruling that many had hoped for. My own take was that the Appeals Court would move expeditiously to quash the notion that America’s trade deficit should be considered an emergency in accordance with the International Emergency Economic Powers Act of 1977. I made the argument on economic terms — that America’s trade deficit is a natural macroeconomic by-product of a chronic shortfall of domestic saving — and drew comfort the CIT’s legal perspective on trade deficits as a “non-emergency” problem.

The good news is that the Appeals Court did not dismiss this key point on whether trade deficits qualify as a national economic emergency. The bad news is the judicial timeline for the ultimate verdict on this point now looks a good deal longer than I had thought. With a full hearing on the appeals case now delayed until July 31, my best guess is that after allowing for the time lags of an Appeals Court verdict and an eventual Supreme Court ruling, we should now count on the lifeline of Trump’s global baseline tariffs scheme being extended for at least another six months.

That drawn-out timeline is important. It provides extended judicial license to yet another one of Trump’s purported emergencies — in this case, America’s trade deficit. Yes, drawing the line on an excessive expansion of executive power is very different in economic matters than it is for addressing social tensions, like dispatching Federal troops to Los Angeles in order to deal with a so-called emergency invasion by illegal immigrants. But the constitutional principles are no less important in both cases.

As I argued last week, the Courts have already hinted at a back-up plan available to the Trump Administration if it chooses to forego the emergency justification for its fallacious tariff remedy to a trade deficit. The option of an extended judicial timeline provides Trump with more than ample time to prepare “non-emergency” back-up plans for its imposition of global tariffs through justification by Sections 232 (national security) and/ or Section 301 (unfair trading practices) of existing trade legislation. As hinted by Trump Administration officials, I suspect those plans are now being drawn up.

Consequently, my bottom line remains pretty much the same: With Trump’s global tariffs likely to remain in place, a China tariff penalty will spur another round of costly trade diversion for a saving-short US economy that remains prone to chronic trade deficits. An enduring tariff war also underscores mounting downside risks to the US and Chinese economies, who have collectively accounted for 40% of world GDP growth since 2010. That spells heightened risk of serious collateral danger on the rest of the world. My take is that the Geneva-London framework is hardly the real deal that bloviating US politicians are attempting to peddle to the American general public.

[NOTE: This post was filed at 19:30 EST on 11 June 2025, prior to the official release of the details of the London “deal.” It reflects 11 June media commentary provided by President Trump, Treasury Secretary Scott Bessent, Commerce Secretary Howard Lutnick, and a Council on Foreign Relations session with US Trade Representative Jamieson Greer. This post may be updated depending on final published details of the latest version of US-China framework deal.]